What's up with Up?

I’m a big fan of Up Banking. They have a pretty good Aussie FinTech story of disruption & success. My birthday’s coming up & that marks five years with them, but… they’ve just introduced a subscription service & I want to talk about that.

Falling in love with Up

Up Banking was a breath of fresh air. A clean, fast & functional app. It is taken for granted today, but I need to emphasize that the banking-app landscape back in 2019 was painful for customers. The traditional banks had zero motivation to innovate. But that all changed with the rise of the Neobanks. Banking could be done differently.

Sentiment for the traditional big banks was trending low. They had their misconduct in the spotlight thanks to the 2017 Royal Commission into the banking & financial services industry. Misconduct aside for a moment, every banking app sucked. Why so slow? Why no PayID? Why does it feel like I’ll lose all my money if I switch banks?

The Up experience was simply better in every way. Everything was instant: digital cards, transaction notifications, create/delete savers. Everything was free: no monthly fees, no separate “travel” card with hidden fees & preloading requirements. They had perks: sign-up bonuses, better interest rates, & Perk-Up, where random cafe coffee purchases were covered by them - very Melbourne. They were the first banking app, that I saw at least, that had accurate crowd-sourced merchant IDs. Incredible! Finally, I don’t have to play cryptic crosswords with my bank transactions to find where I’ve spent my money.

The feature set kept growing & they were bangers:

- AfterPay, another Aussie FinTech success story, had taken over the scene (for better or worse). Up integrated into their app so that you could forecast charges. No banks were doing integrations like that.

- Cover transactions or forward payments to/from savers with a long-button press. Perfect for bucket-budgeting & I still use it religiously.

- Emojis & GIFs. If I can’t send my mate the $10 I owe him for a souvlaki without a GIF of someone eating a souvlaki, then what’s the point of getting out of bed in the morning?

- Detail-rich transaction history, trackers, automatic categorizing transactions, UpYear in review - I mean I could tell you down to the cent how much money I have spent at Kalimera Souvlaki Art in Oakleigh & it will shock you.

It was clear that people put love & attention into what they were making. Oh god, listen to me! I’m falling in love with a brand…

Our love was special

It was love. Completely one-sided, yes. But it was love & it was special. What other customer support chat am I drunk messaging at midnight? Only Up.

It became a running joke among my friends…

“Does it smell like Up in here?”

“What’s up?”

“I’m glad you asked… [proceeds to give the spiel]…”

I would sell my friends on it. An easy sell mind you. They’d join. We’d both enjoy the sign-up bonus, & I would consider them a part of my “downstream”.

“Is this a pyramid scheme?”

“No no, the logo is a triangle. See! Very different!”

“I’m a level 3 Upsider. At level 5 I get access to my downstreams’ saver accounts.”

Speaking of which, consider joining Up! Use this referral link for $10 on sign-up.

Why did you care so much, Matt?

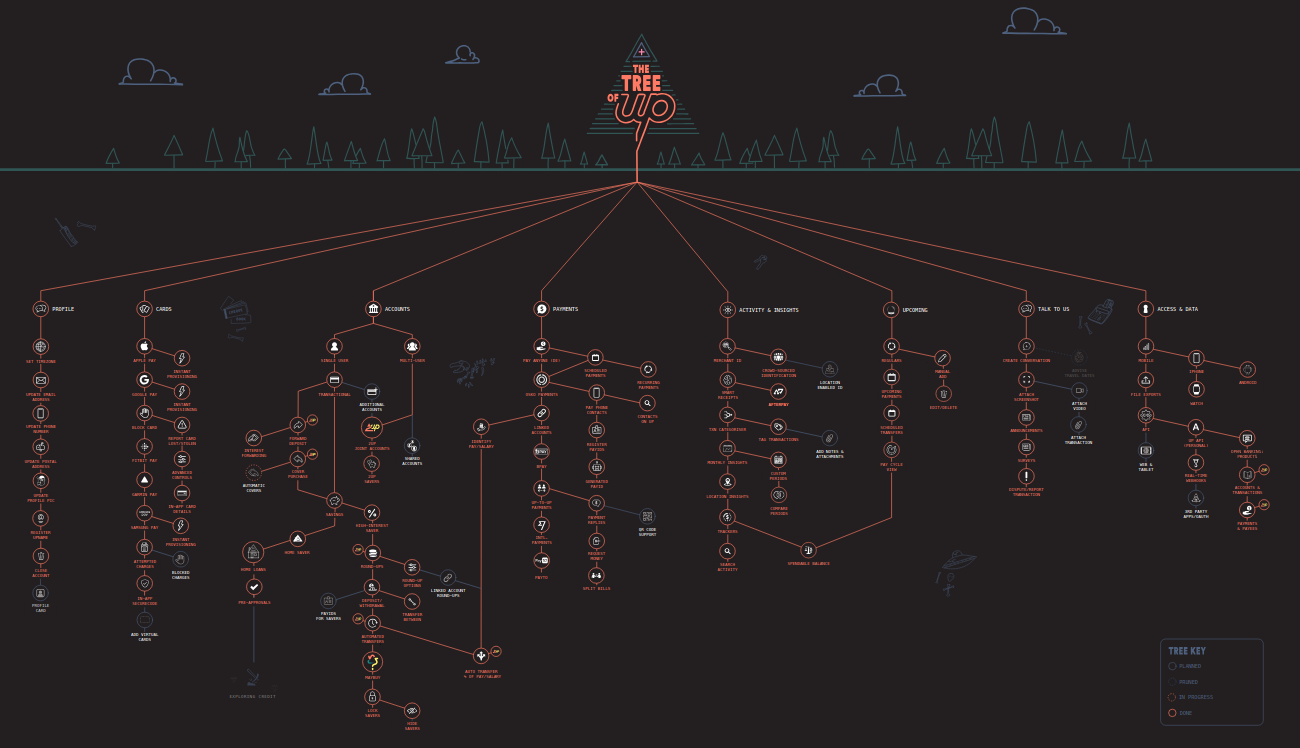

I was studying engineering, leaning towards specializing in software, & a successful local FinTech startup felt akin to something from Silicon Valley. Ferocia, the company behind Up, was a tech company first & bank second. I mean, what bank provides a feature roadmap like the Tree of Up & that looks as good as that does? Releases were monthly, you could follow their progress, & were encouraged to contribute ideas. You could get involved. Social meet-ups. Free tote bag & t-shirt. They even released an API for hackers & hobbyists to mess with - which I did (up_woolies).

From a technical perspective, I was interested in the problems they had to solve & how they solved them. You could find podcasts that featured Dom Pym, co-founder, or Anson Parker, head of product, & learn from their experiences. I recall listening to discussions on the thoughts behind “Multiplayer” joint accounts or how to stop payment abuse. As an aside, I briefly bumped into Dom at the MayBuy feature release pop-up in Melbourne. I was more interested in shaking Dom’s hand than noticing Client Liaison was there for the promotion.

The Era of Neobanks

It wasn’t all sunshine & rainbows for these neobanks, though.

They were on a timer. They had big concerns looming: the money running out, market saturation & the traditional banks catching up. Up was burning through funding to successfully grow its customer base, but that base was far from profitable. A business needs to make money (eventually) & banks primarily do that through lending. However, most neobanks weren’t offering lending services - most likely due to the regulations & licensing that continue to create a massive entry barrier for new banks.

Up wasn’t the only kid on the block. The Aussie banking landscape was under disruption from a wave of VC-backed startup neobanks, & the market was reaching saturation. Up had entered the market relatively early. They skipped the banking licensing hurdle by partnering with Bendigo Bank to utilize their ADI license - Up’s app, but Bendigo Bank’s accounts. Ferocia, if I recall correctly, had been spending time building a banking app for another big bank which ultimately never saw the light of day - so, they had the expertise & a product they could eventually launch.

It wouldn’t surprise me that Up’s entry into the market forced the hand of other neobanks still in development. The race had started & they needed to be in it. However, the main differentiating factors between these neobanks were their features. Each of them offered a sign-up bonus & competitive interest rates, but they didn’t all have covers/forwards, seamless travel card services, or built-in back-and-forth customer chat. Once you went Up, there was reason to come back down.

The traditional banks were also mobilising. The neobanks had just siphoned their customer base. It was enough justification & proof that investing in their own apps would retain, & perhaps retrieve, their customers. The old banks still offered more services - lending, business - that would tilt the scales in their favour so long as their app & the user experience were on par. In the tech world, this is a tale as old as time: the big business gets disrupted, they copy the disruptors, & offer a larger suite of services.

Winners & Losers

So how many Aussie neobanks survived (that I can remember)?

- 💸 Up was bought by Bendigo Bank (late '21)

- 💸 86:400 bought by NAB & consumed by their subsidiary uBank (early '21)

- 💀 Xinja died (late '20)

- 💀 Volt Bank died (mid '22)

- 😐 Many traditional banks invested in their old apps

Coming down from the (Up) high

Even before the acquisition, Up was focused on improving one’s relationship with money & banking. But, it began to feel as if they were targeting a demographic that was “bad with money” - whatever that means. This took the form of several feature releases & brand engagements: Locking Savers, Save Up 1000, She’s on the Money, MayBuy, & the Financial Sound System.

First, it was Triple J, & now it is Up… I’m no longer the target demographic. I’m no longer a uni student looking for free club snags & a beer. I’ve got a big-boy job & enough money to hold an Urban Climb membership. The last release that I was excited about was for Up Home - home loans & education. The excitement, for me, has slowed. Months of “clean up” & improvement updates. The Tree of Up has seemingly stopped growing.

It’s not hard to believe that Bendigo Bank, having forked out $116m to acquire Up, wishes to start turning a profit from the large customer base it purchased. How do you do that when the bank you’ve bought has been marketing to a young, low-income, & financially-stressed demographic? Home loans? A subscription service?

Introducing, ☁️ Up High ☁️

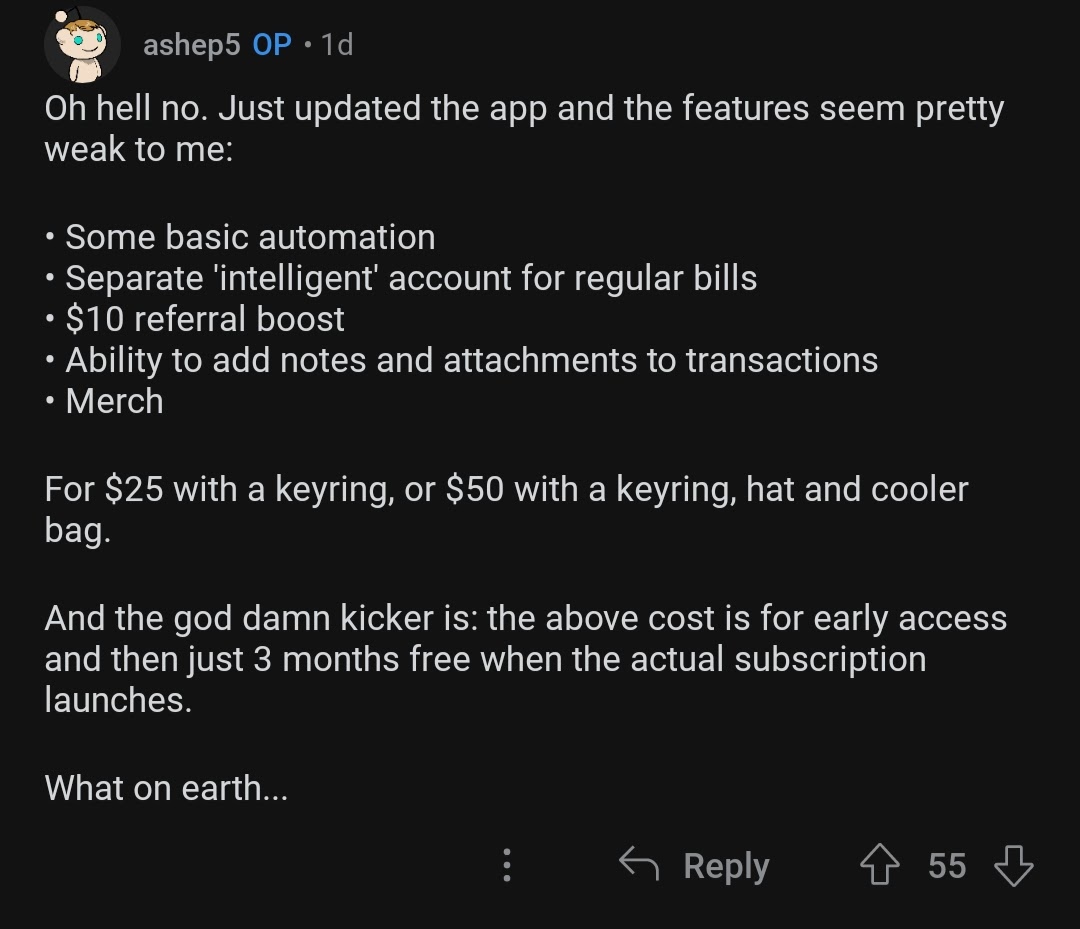

A subscription-based service for Up Banking. Early access entry fee $25/$50.

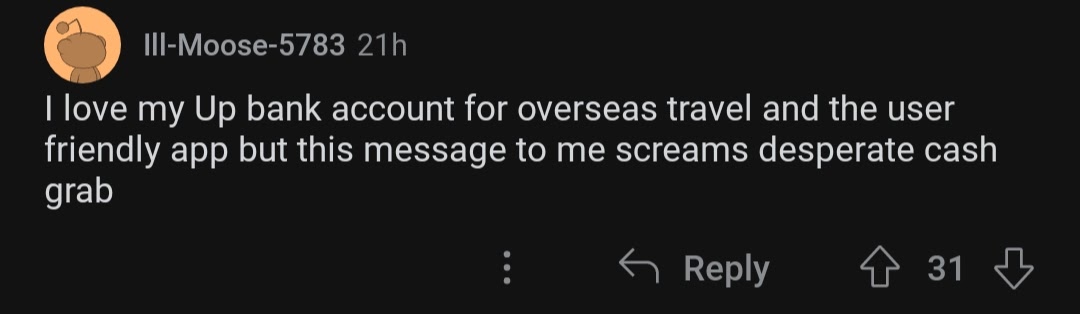

It feels icky. Did we re-invent monthly banking fees? Did we come full circle?

What does this pay for? Early access to one new feature, Auto Covers, which has been on the roadmap for years since the introduction of Covers/Forwards - Anson has explained that one (blog). Anything else? Oh yeah, cosmetics & “access to limited merch”.

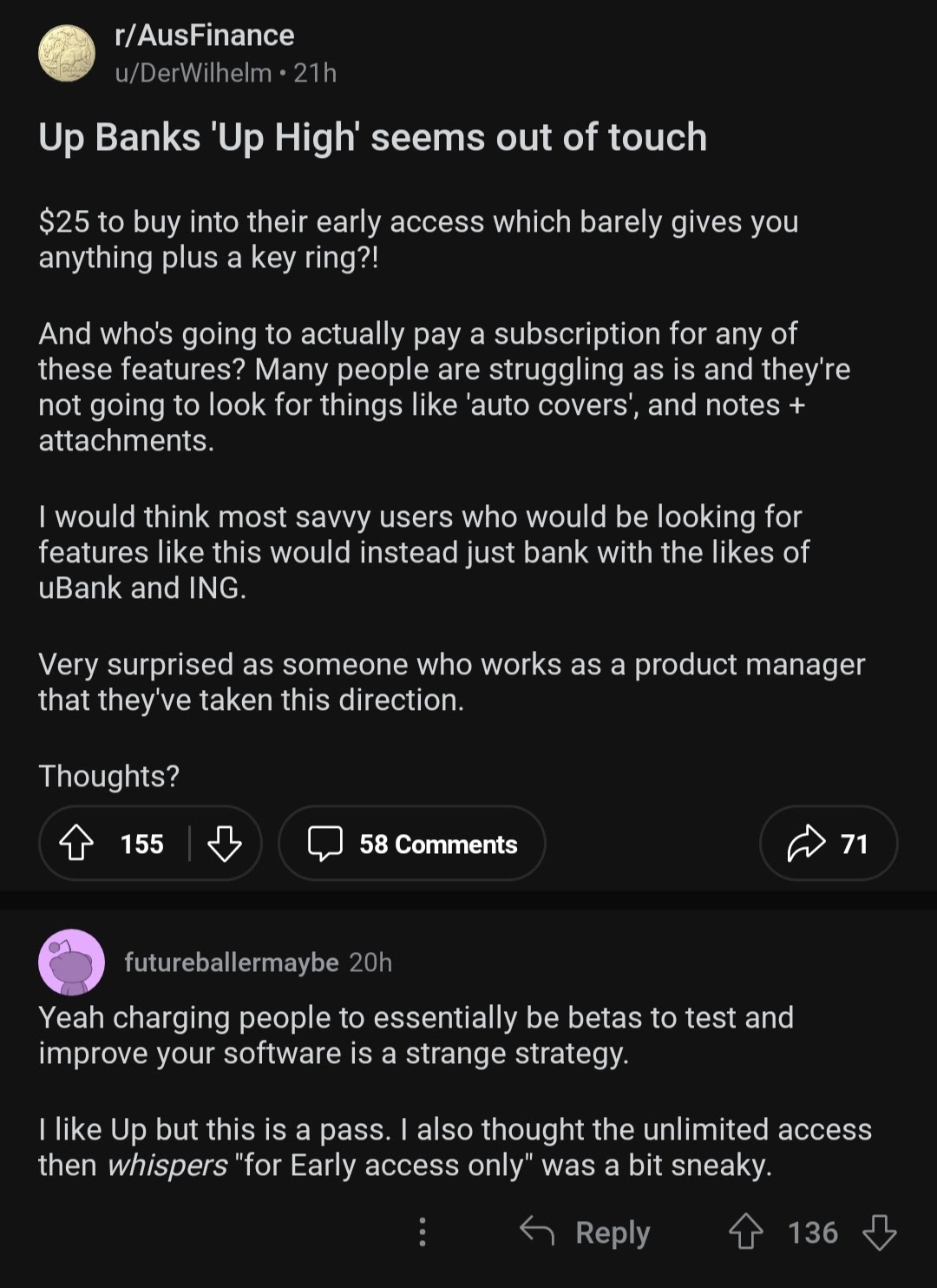

Consensus is mixed to put it lightly:

End Game

I like Up. I like the Aussie FinTech space. I’m put off by a bank subscription service, but oh well. Perhaps, within this space, we’ve hit the next ceiling for innovation, or now lack the business motivation to innovate further. The disruption caused by BNPL & neobanks, the COVID tech bubble bursting - it feels like the market has settled down.

The mood has undeniably changed.

(I still bought Early Access though)